by Das Brain

Intro To Option Trading – Part 6a

What else can I do with option contracts?

PUTS as insurance on your current stock holdings (protective put strategy)

Yes, you can use PUT option contracts as insurance to your current holdings. So, if you think that the stock market is going to tank like it has recently (over the last few days Dow Jones down over 200 points) and you want to protect your current holdings 1000 shares in let’s say Microsoft then what you can do is buy 10 PUT option contracts with a strike price that is ITM, ATM or slightly OTM (In The Money, At The Money and Out of The Money).

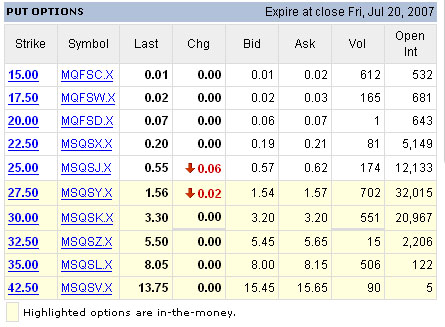

Let’s say the current price of Microsoft is $27.25 and you anticipate that it will go down. In light of this you may want to purchase the 2007 July $27.50 for a premium of $1.56 or July $25 PUT option contract for $0.55. You of course multiply the premium by 100 since 1 contract represents 100 shares, then you have to multiply the premium by 10 because you want to protect 1000 shares (1000 / 100 = 10). So that will be $1560 for 10 PUT contracts with the strike price of $27.50, and $550 for 10 PUT option contracts with the strike price of $25.00.

The question you might be asking is “So how do I make money from this INSURANCE?”

The answer to this is you might make money or you might not. It really depends on if your prediction that the Microsoft (NYSE:MSFT) shares will fall below either the strike price of $27.50 or $25 depending on which PUT contracts you have purchased. If you are correct and the stock price of Microsoft does fall to $23.60 in June 2007, for example on the PUT options with a strike price of $27.50, the premium of the PUT option contracts will go up (hypothetically) from $1.56 to $2.60.

So that is a difference of $1.04 ($2.60 – $1.56 = $1.04) and if you sell all your option contracts at this current price then you will make 10 option contracts multiplied $104 ($1.04 X 100). Your profit would be in this case $1040.

Now of course the opposite could happen where the price of Microsoft goes up instead of down and if it is June 2007, you could lose the amount you paid for those PUT option contracts, sometimes however those contracts may be less than what you paid for them and you can sell all the option contracts to recover some money from them before the expiration date in July 2007.

75% off Option Trading E-books at ReadLearnTrade.comÂ

Using PUT option contracts as insurance to protect against decline of stock prices of current stock securities that you hold is a good strategy, however it does have its risk. You could make money or you could lose the entire “INSURANCE” amount which is what you pay for the PUT option contracts. The best way is to think of it this way. When you pay for your car insurance do you get anything back, if you don’t get into an accident? You only get something back if there is in the form of repairs, or the current cost of the car if you total it. The same applies when you use PUT option contracts as insurance.

Please read my DISCLAIMER page.

Bookmark at:

StumbleUpon | Digg | Del.icio.us | Dzone | Newsvine | Spurl | Simpy | Furl | Reddit | Yahoo! MyWeb