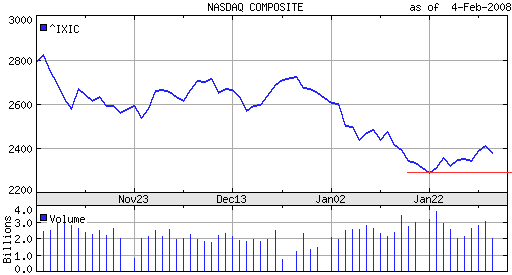

A recent report shows that Canada has the world’s most stable banking system, unlike Canada’s neighbors to the south, the United States currently ranks 40. The U.S has suffered a financial industry, stock market collapse due to de-regulations which allowed their banks to do anything they want, including greedy un-scrupulous lending practices.

A recent report shows that Canada has the world’s most stable banking system, unlike Canada’s neighbors to the south, the United States currently ranks 40. The U.S has suffered a financial industry, stock market collapse due to de-regulations which allowed their banks to do anything they want, including greedy un-scrupulous lending practices.

Read the article below.

I added a new category to my blog called “Trading Psychology” to explore of course the psychology of trading, whether it be stock, option, futures or foreign exchange trading.

I added a new category to my blog called “Trading Psychology” to explore of course the psychology of trading, whether it be stock, option, futures or foreign exchange trading.

Â In my last post of “

In my last post of “

Â