As you can see from the chart above, the Dow Jones Industrial Average has had quite a drop since last october, from 14,000 top down to now around 7000 points. Is the worst over? Have the markets hit bottom yet?

As you can see from the chart above, the Dow Jones Industrial Average has had quite a drop since last october, from 14,000 top down to now around 7000 points. Is the worst over? Have the markets hit bottom yet?

Knowing when to play the gaps for trading stocks and options is the subject of this Part 5 of the Trend Trading video trading course. This is a good video for beginners to learn how to make money with gaps, and how to identify and profit from them.

Click on the PLAY button on the flash player below to begin the video.

I’ve been out of the market since March 2008 and for a good reason. The subprime financial mess has far and wide reaching ripples effects which is now causing more and more problems for the financial markets.

Today, Lehman Brother files for bankruptcy and Merrill Lynch was forced to sell itself to Bank of America for $50 billion in stock, sending the U.S stock markets tumbling and investor confidence down with it.

I was wondering to myself “Is the 415 point rally the stock market had on the Dow Jones Industrial sustainable?”

The answer here is no, the stock market is really volatile. Today, the Dow is down about 235 points right now due to bad news from the financial sector, which will in the near future I think keep rearing its ugly head.

In the next few weeks to month, I will be looking to buy into long-term option contracts of selective stocks that look like they’ve reached a bottom. In the last 6 months buying shorter-term CALL option contracts has lead to some losses in my portfolio to be honest.

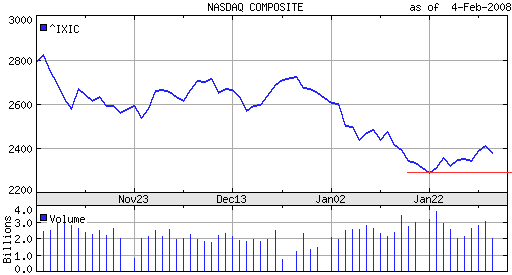

Look at the chart below of the $DJX, the decline started from mid October 2007 to just January 22, 2008 then a bounce and now we are heading back down.

To be on the safe side, I will now only look at LEAPS which are long-term option contracts with at least 1 year before expiration. Looking at the $DJX Dow Jones 100 chart we can see to the far right of the chart, recently the Dow Jones market has try to form “W” shape but failed, and it looks like it is dipping back down. Read the “Trading the 123 Strategy” for double bottom info.

My guess here is the $DJX may go back down to the 122 (DJIA would be 12200) before turning up or go sideways more with a series of small bounces.

I little while ago I finished the CD-ROM course by Kevin Haggerty called “How to successfully trade the 123 strategy.” It took me about a month, using whatever spare time I had, however those with plenty of spare time can finish the Kevin Haggerty course in a week or less.

I little while ago I finished the CD-ROM course by Kevin Haggerty called “How to successfully trade the 123 strategy.” It took me about a month, using whatever spare time I had, however those with plenty of spare time can finish the Kevin Haggerty course in a week or less.

The course is basically an in-depth look at double bottoms and double tops. It should be called “How to trade double bottoms and double tops,” but that I guess would not sell any courses, so they use a fancier title.

Recent weak economic reports in particular today from the service sector, has turn the markets down. At the time of writing this post, the Dow Jones is down by 293 points, and the Nasdaq (above chart) is down 54 points. From the looks of it, my guess is that the indexes will retest the lows set in the last few weeks.

by Das Brain

In this post called ”When To Buy A Stock or Option – Market Timing – Part 3″, I am going to mainly focus on short-term trading, as in Part 1 and Part 2 the subject of long-term and intermediate term timing was covered.

One thing to note, that the reference to “timing” here is a indication of entering a “long position” or buying a stock or option in anticipation the price would go up.

Â

Â

by Das Brain

When trading in the financial markets, whether its stocks, options, foreign exchange or commodities knowing when to buy and sell, obviously is the key to profiting and also the key to avoiding losses. To know when to buy and sell financial instruments, you must as a trader or investor look at charts and know how to read the charts using “technical analysis.”